- News

- Fri Aug 13

Dividend strategies to help hedge inflation

Although Federal Reserve officials expect inflation to be transitory, the loss of purchasing power is a risk for both retirees and investors saving for retirement. For that reason, an increased allocation to equities with dividend growth may provide a hedge against inflation for some investors, in our opinion.

We also believe that dividend investing has become a larger portion of the benefit to owning equities for wealth accumulation. Investors should focus, in our view, more on total shareholder return rather than simple price appreciation, as it includes dividend income.

Dividends primer

Dividends are a cash return on your investment in a stock or bond — payable to you as a shareholder. Dividends are also potential indicators of quality, value and future growth. To enable shareholders to participate in the company’s growth, the board of directors can declare the distribution of dividends from a portion of earnings or free cash flow. Dividends are paid in cash, additional shares or other property, such as shares in a subsidiary spin-off.

Notable risks include:

- Dividend payments are not guaranteed

- Dividend stocks tend to be value-based (versus growth stocks)

- Dividends can be negatively impacted by taxes and inflation

Portfolio strategies amid strong dividend growth

With increasing COVID-19 vaccination rates and an improving economic outlook, U.S. common stock dividend increases in first quarter 2021 totaled $20.3 billion.1 That is the largest quarterly increase in nearly a decade, since first quarter 2012, according to S&P Dow Jones Indices data. Analysts are forecasting S&P 500® Index dividends to rise 4.4% in 2021, year over year, based on FactSet estimates.

We believe dividend strategies are appropriate for investors with well-diversified portfolios and intermediate to long-term time horizons. We encourage you to consider personalized dividend-investment recommendations from your Ameriprise financial advisor. They understand your financial goals and needs and can factor dividends into your overall investment mix (asset allocation).

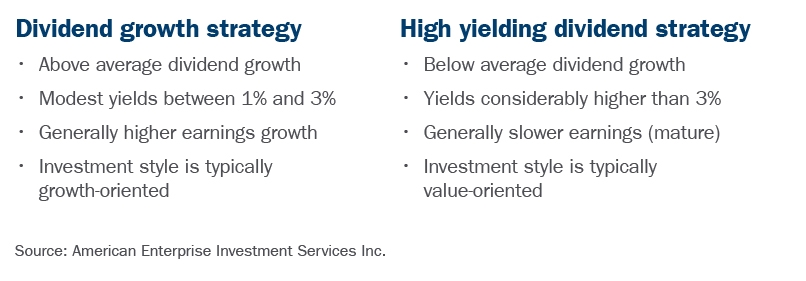

The Ameriprise Investment Research Group classifies dividend-paying equities into two segments:

- High dividend growth companies that typically increase their dividends faster than the overall market

- High yielding companies that pay out a greater percentage of earnings as dividends, compared to their peers

In or near retirement

For individuals in or nearing retirement, high yielding dividend income may be more appropriate. The Consumer Staples, Health Care, Real Estate and Utilities sectors can offer options with yields exceeding the overall S&P 500.

Accumulating toward retirement

On the other hand, high dividend growth may be more appropriate for individuals with a longer time horizon. Those in between may consider a combination strategy. In our view, the Information Technology and Financials sectors can offer attractive opportunities for dividend growth.

Conclusion

Dividends have the potential to significantly improve total returns and enhance risk-adjusted returns to help mitigate volatility. Dividend growth and income can also potentially neutralize inflation, produce tax shields and take advantage of compounding and reinvestment that is generally not available in other income-producing investments (particularly fixed income).

Our advice remains to seek personalized recommendations from your financial advisor, start small, grow over time and remain in the right dividend strategies. Stay dedicated to quality factors and understand that wealth accumulation takes discipline and patience.

To learn more about dividends, contact Associate Vice President, Ameriprise financial advisor Peter Weinbaum

Contact Ameriprise Financial Services LLC – Peter Weinbaum

Someone will reach out to you soon!

We respect your privacy and will never spam or sell your information.